Proven Benefits

Proven Benefits of Home Loan Transfer

by Priya Bagga Posted on24

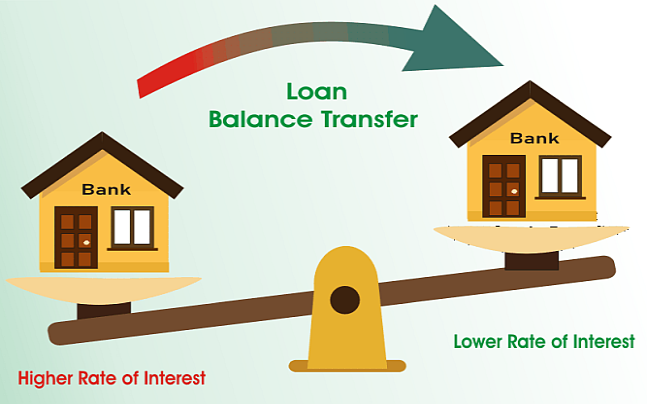

Ahome loan balance transfer is the process of transferring a housing loan from one lender to another. Borrowers usually opt for this facility when they are not satisfied with their existing lender, and managed to negotiate better terms with another lender.

Once the new lender approves this takeover, they pay the outstanding amount to the current lender. After receiving the full amount, the existing lender releases the property documents and a no-objection certificate to the borrower. Borrowers then hand over these documents to their new lender and pay all the future EMIs to the same as per their home loan regulations.

Benefits of Home Loan Balance Transfer

Aspiring homebuyers can use this facility to avail the following benefits –

Opting for a low-interest rate

The primary reason behind home loan transfer is the low-interest rate. After availing a home loan and repaying EMIs for some months, borrowers may be subject to an interest rate hike.

For example, a borrower has availed a home loan at 10%. After paying EMIs for one year, he realises that another lender is charging 9% on home loans. In such a scenario, he has the provision to switch lender to avail a better interest rate.

Borrowers can use a home loan balance transfer calculator to assess how much they can save with this facility.

Zero part-prepayment and foreclosure charges

Home loan refinance facility helps individuals to opt for a lender who offers a no-cost part pre-payment and foreclosure facility.

Therefore, if they decide to part-prepay or foreclose their home loan in future, they can save a considerable amount by not paying the associated charges.

Customised insurance options

Few financial institutions offer customised insurance solutions along with home loan balance transfer facility. It safeguards a borrower’s financial interest against any unprecedented incident.

Availability of top-up loans

Financial institutions offer the facility of a top-up loan when a borrower opts for a home loan balance transfer with them. This additional credit has no end-use restriction; thus, homeowners can fulfil their urgent financial needs with a top-up loan.

Opportunity to improve credit score

Last but not least, in case a borrower is struggling to repay his/her home loans with the current lender, it can adversely affect his/her credit score. With the help of a home loan balance transfer, they can make their home loan EMIs more affordable, and get a chance to improve their credit score with successful repayment.

However, before opting for aloan balance transfer facility, borrowers should take not of the required eligibility criteria.

Eligibility Criteria for a Home Loan Balance Transfer

- The property in question should be occupied or ready to occupy.

- Borrowers must have paid at least 12 EMIs without any dues.

Documents Required for a Home Loan Balance Transfer

Borrowers need to submit the following documents required for a home loan balance transfer –

- KYC documents.

- Income proof, i.e. salary slip, Form 16, etc.

- Bank account statements for the last six months.

- Existing home loan documents.

- Property related documents.

A home loan balance transfer is an ideal way to manage any difficulties during repayment. Borrowers can effectively reduce their EMIs with a balance transfer and make use of a home loan balance transfer calculator. However, they must read the terms and conditions associated with it before availing this facility.

I’m Anant, a 27-year-old website administrator from India. My main task is ensuring the stable operation of online platforms. When I’m not working, I enjoy playing sports and studying ancient cultures.